Anchorage Digital Trading

Digital asset trading for institutions

Anchorage Digital offers advanced trading capabilities for institutions, including spot, margin, and derivatives. Trade via API, a fully featured, self-service interface, or navigate large-size, illiquid asset, and complex trade requests with the help of our expert traders available 24/7/365. Execute across 13 order types and access global liquidity—all on infrastructure trusted by institutions for over six years.

Trade hundreds of assets

Customizable access to crypto with a world-class digital asset platform for institutions*

OTC spot & derivatives

Access tailored over-the-counter solutions for flexible, large-size trades.

Global liquidity

Institutional-grade liquidity with deep market access.

Analytics and insights

See pre-trade, scenario-based analytics, transaction cost analysis, or hedging simulations for your trades.

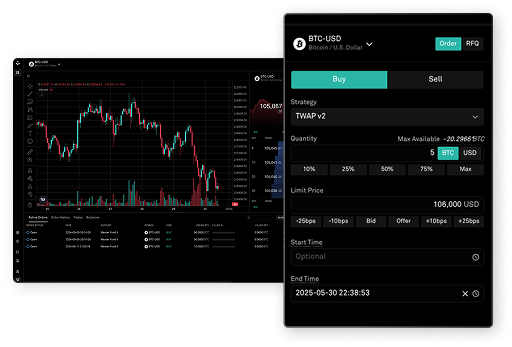

Multiple order types

Choose from a wide range of order types including benchmark, TWAP, iceberg, and pegged.*

Leverage with margin trading**

Achieve capital efficiency with T+1 post-trade settlement and margin trading.

24/7 trading support

Engage with our always-on trading desk to quote, structure, and execute large or complex trades—backed by institutional-grade service.

*Agency spot trading is with Anchorage Hold, LLC, and offered to N.Y. institutional clients only by Anchorage Digital New York, LLC. ** Margin trading offered through A1 Ltd.

A fully featured, self-service interface

Gain real-time visibility into trade history, settlement status, and market data.

Specific asset availability for trading dependent on jurisdiction and service. Agency trading with Anchorage Hold, LLC, only. Digital asset trading services are provided by Anchorage Hold LLC. A1 Ltd. is a principal trading business.

Trading with Anchorage Digital vs. others

.svg)

Digital asset trading services are offered to N.Y. institutional clients by Anchorage Digital New York, LLC (Bitlicense #0000041). Trading interface, order types, analytics, and access to Anchorage Digital traders available via agency trading only.

Scroll >>

.svg)

.png)